The New Asc Topic 606 for Revenue Recognition

ASC 606 Model Based on transfer of control Single revenue standard for all contracts with customers The standard is more principles-based than current guidance Potential changes. Determine the transaction price.

The Payments Industry Is Evolving Propelled By Technological And Operational Innovations Applying The New Revenue Risk Management Recognition Capital Market

Audit Assurance Home Audit Innovation.

. For private companies now tasked with ASC 606 implementation the model supersedes most legacy guidance and fundamentally changes how entities need to think about revenue recognition. Public business entities certain NFP entities and certain employee benefit plans were required to apply the guidance in Update. The core principle of ASC 606 is that companies should recognize revenue when promised goods or services are transferred to customers in an amount.

Our roadmap can help you manage this process. Our understanding of the new standard combined with industry insight can help both public and private companies anticipate the sometimes challenging terrain ahead. In 2014 after years of deliberations the Financial Accounting Standards Board the FASB and the International Accounting Standards Board the IASB jointly issued the Accounting Standard Update ASU No.

This changes everything for the SaaS industry and it could be very stressful considering non-compliance is not an option. Initial franchise fee revenue should be True True recognized when all material services or conditions relating to the sale have been substantially performed by the franchisor. The new revenue recognition standard ASC 606 outlines a single comprehensive model for accounting for revenue from customer contracts.

ASC 606Revenue recognition Since the issuance of the new revenue recognition standard Deloitte has been lighting the way for clients. Many Atlanta businesses have already started the process of complying with the new ASC 606 Revenue Recognition standard. Topic 606 includes implementation guidance on when to recognize revenue for a sales-based or usage-based royalty promised in exchange for a license of intellectual property.

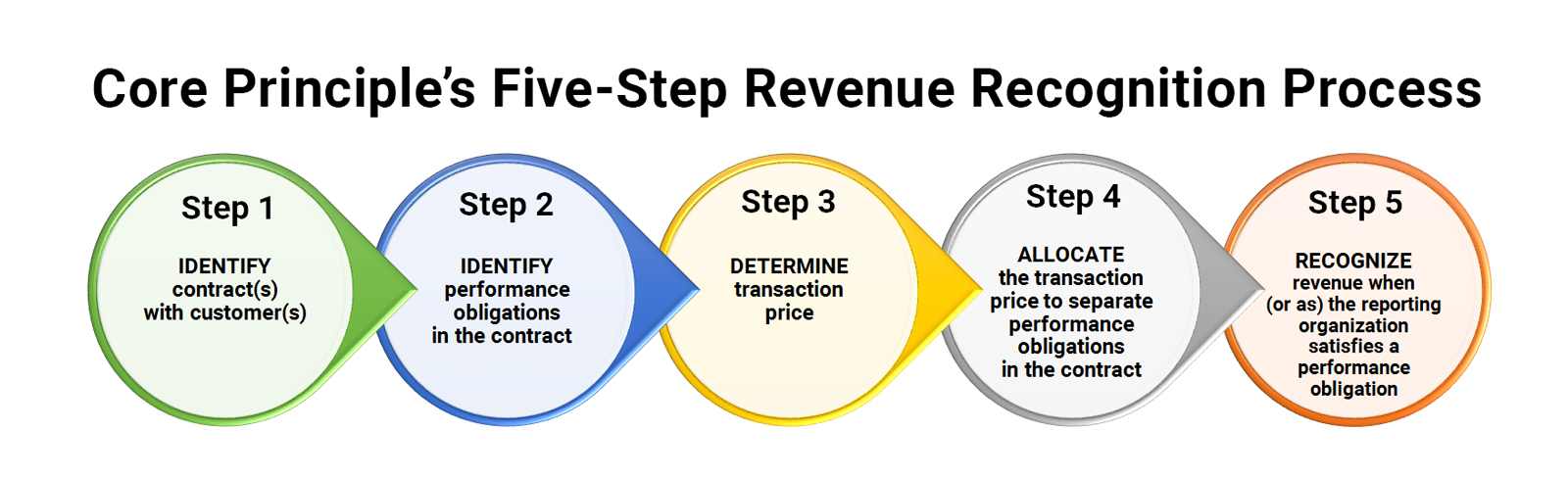

New ASC Topic 606 -Provides a five-step model for evaluating how and when revenue should be recognized rather than providing detailed industry-by-industry standards. Transfer of control rather than risks and rewards under current GAAP Upon adoption of the standard changes may arise from recognizing revenue at a point in time to over time and vice versa in some scenarios One common scenario in which this change in timing may occur is in the. 2014-09 codified primarily in ASC 606 and IFRS 15 respectively.

The new ASC Topic 606 for revenue recognition. Revenue recognition methods under ASC 606 should cover criteria timing and other core aspects of contract revenue recognition. ASC 606 provides guidance that will apply to all entities including non-public entities that previously did not have extensive guidance.

ASC Topic 606 provides a five-step model for True True evaluating how and when revenue should be recognized rather than providing detailed industry-by-industry standards. ASC 606 is the new revenue recognition standard that affects all businesses that enter into contracts with customers to transfer goods or services public private and non-profit entities. -Is far more principles oriented than the existing standards which tended to be more rules based.

An entity recognizes revenue in accordance with the core 1. The amendments in this Update clarify the scope and applicability of this guidance as follows. At the most basic level revenue recognition under ASC 606 means revenue is recognized when the contractual obligation is met and not when the payment is made.

WELCOMING THE NEW REVENUE RECOGNITION STANDARD. Both public and privately held companies should be ASC 606 compliant now based on the 2017 and 2018 deadlines. Identify the contracts with a customer.

Eliminates both the percentage-of-completion method and the installment sales method of revenue recognition. Multiple Choice addresses when and how revenue should be recognized in contracts that provide both goods and services to customers. Five steps Explanation is as follows New ASC topic 606 provides five step model for revenue recognition which includes following Step 1.

Originally scheduled to become effective earlier the Financial Accounting Standards Board FASB voted to delay the implementation one year due to the COVID pandemic. The amendments in that Update def erred the effective date of Update 2014-09 for all entities by one year. Deferral of the Effective Date.

The new revenue recognition standard Accounting Standards Update 2014-09 Revenue from Contracts with Customers Topic 606 is similar to existing guidance but there are some crucial differences. Allocate the transaction price to the performance obligations in the contract. As discussed in FASB ASC 606-10-05-4.

Differences in the number of performance obligations Disconnectbetween billing and revenue recognition More estimates included in revenue. The FASB codified the amendments in ASU 2014-09 in Topic 606 Revenue from Contracts with Customers which unlike the voluminous and often industry-specific revenue recognition rules it replaced calls for a single principle-based model for recognizing revenue. Both public and privately held companies should be ASC 606 compliant now based on the 2017 and 2018 deadlines.

The core principle of Topic 606 is that an organization should recognize revenue in a way that matches when the organization has met each obligation whether goods or services under the contract and the revenue should be recognized at a value commensurate with such obligation. Uncertainty of revenue and cash flows arising from a contract with a customer. Identify the performance obligations in the contract.

The new standard will also require additional revenue disclosures. Revenue from Contracts with Customers Topic 606. ASC 606 By C A Ambalika Singh VG eBay.

New Guidance on ASC 606 for Business Combinations. Principles in the Topic 606 relate to the. We lay out the five-step revenue recognition process plus some significant judgments you.

Revenue recognition compliance What is ASC 606. ASC 606 the new revenue standard replaces virtually all including industry-specific US. Will require companies to recognize a net liability contract position on.

ASC 606 is the new revenue recognition standard that affects all businesses that go into contracts with customers to transfer goods or services - public private and non-profit entities. Identify the contract with customer Step 2Identify performance obligations Step 3Determine the Transacti View the full answer.

New Revenue Recognition What Does My Nonprofit Need To Know

Revenue Recognition Certification Continuing Education Credits Continuing Education Professional Education

Fasb New Standard On Revenue Recognition Are You Ready For Asc 606

Komentar

Posting Komentar